The ITR-1 and ITR-4 (online and offline), and ITR-2 (offline) are currently available on the new portal. This new e-filing website will soon replace the existing portal.The new portal is user-friendly and focuses on making the entire e-filing experience easy, quick, and seamless.

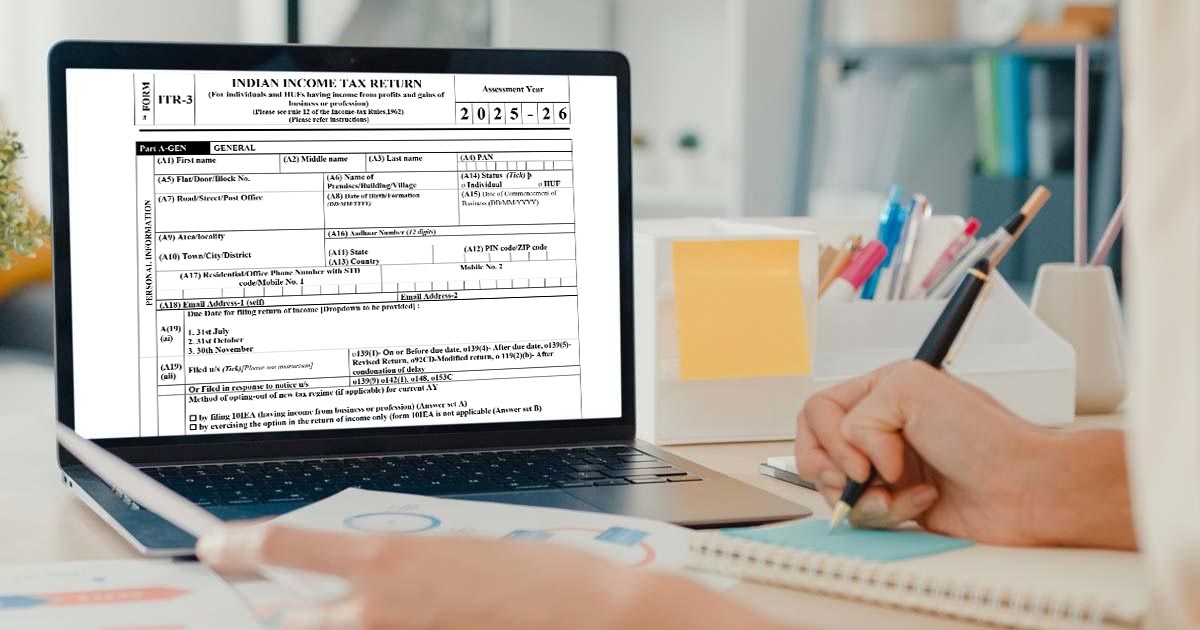

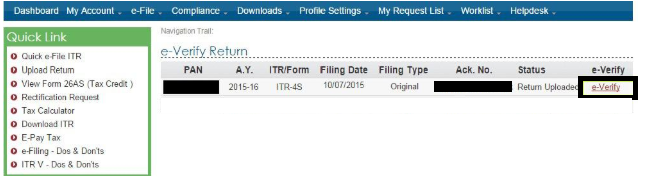

The Income Tax Department has launched its new e-filing website on the 7th of June, 2021. Section 194P has been newly inserted to enforce the banks to deduct tax on senior citizens more than 75 years of age who have a pension and interest income from the bank. Such senior citizen taxpayers have only pension income and interest income as their annual income source. Union Budget 2021 proposes to exempt senior citizens from filing ITR 1. You can file ITR 2 either by preparing online on an e-filing portal or by filling an excel utility. ITR 2 is applicable only to individuals and HUFs who do not have any income from business or profession. The applicability of ITR 2 depends on the category of the taxpayer and the source of income. Major Changes Made in ITR 2 for Assessment Year 2020-21.

0 kommentar(er)

0 kommentar(er)